MicroStrategy's Bitcoin Stake 'in Profit' Finally: Investors Add Ethereum, XRP

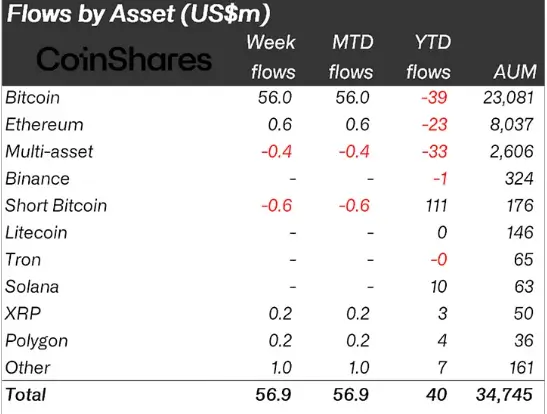

Crypto fund flows have yet again started painting a favorable picture. Institutions have begun re-directing funds toward crypto assets. Just over the past week, digital asset investment products saw inflows summing up to $57 million. In fact, this brought back flows to the positive territory on the YTD frame. According to CoinShares’ latest weekly report, the sentiment is currently positive among investors.

Bitcoin was the largest beneficiary of this week’s action. It registered $56m of inflows. The same made up 98% of all positive flows. Short-Bitcoin products on the other hand noted outflows, bringing to light the refining sentiment.

Last week, and the week before that, Ethereum noted outflows of $2.8 million and $5.2 million respectively. However, this week, the tale was different. Ethereum’s number managed to step back into a positive territory and flashed a value of $0.6 million.

Alongside, Altcoins like XRP and MATIC also registered inflows worth $0.2 million each. Furthermore, the report highlighted,

“While the focus was primarily on Bitcoin, 7 altcoins saw minor inflows, most notable were Uniswap, Polkadot and Polygon with US$0.5m, US$0.4m and US$0.23m respectively.“

Also Read: Bitcoin Surpasses $30,000, 10 Months After Falling Under

MicroStrategy is one of the largest Bitcoin accumulators. Less than a week back, Michael Saylor’s firm bought 1045 BTC for $29.3 million. Nevertheless, the company’s investment has been in the red since June 2022. Post today’s $30k breakout, MicroStrategy’s $4 billion Bitcoin bet proved to be fruitful as it managed to return back to floating profit after nearly 10 months, making it another positive takeaway.

Also Read: Are Ethereum Traders ‘Hesitant’ Ahead of Shanghai Upgrade?

Is fear being replaced by greed?

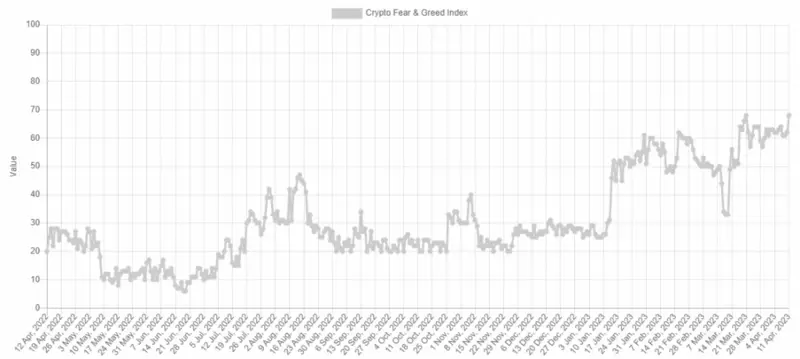

Until recently, crypto investors were in fear. However, with the conditions changing, and Bitcoin re-claiming $30k, the dynamics have flipped. As shown below, the F&G index is currently at its one-year peak at the moment.

At press time, it flashed a reading of 68. On one hand, this may seem to be a good sign, because Greed could foster accumulation, and in turn, help the buying-momentum bloom even further. However, it should also be borne in mind that whenever investors get too Greedy, the market generally becomes due for a correction.

Also Read: Bitcoin Price ‘No Longer’ Displayed on China’s TikTok Version

Comments

Post a Comment